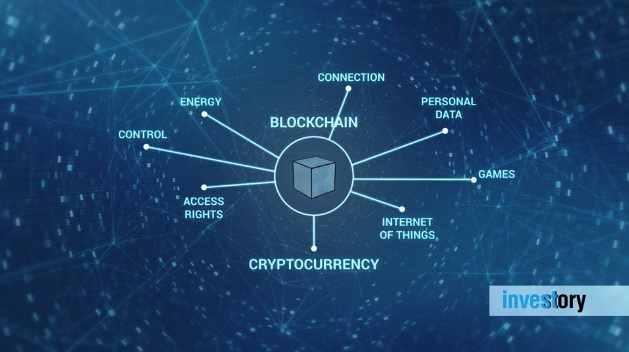

To protect financial data from fraud, a double-entry accounting system was invented in 14th century Genoa. Nowadays with blockchain technology, it’s possible to turn accounting into a completely secure, transparent and easy-to-navigate format. Blockchain is a list of electronic records, where each party has access to the records of every transaction. This data is impossible to corrupt, counterfeit, change or steal.

Blockchain in Cryptocurrency

Initially, blockchain was only used in cryptocurrency. However, this list of records is great for working with a number of different types of data, including financial operations.

Blockchain in Accounting: Bank Wires, Registry of Shares, and More

With the introduction of Blockchain, accounting can now be completely secure, transparent, and easy to navigate. Today, the Bank of New York Mellon is using block chain to control bank wires, keeping track of all financial moves. The state of Delaware, together with the New York company Symbiont, are using block chain for the registry of shares and for reporting to shareholders.

Innovative Accounting Projects: SkyWay, Microsoft, and More

Block chain technology serves as a base for a number of innovative accounting projects. Stampery, a service from the SkyWay company, provides tools for digital verification by creating unchangeable notarized documents. This service has already been integrated into Microsoft Office’s package. Factom protocol is expanding the volume of basic data stored in Block chain, increasing the capacity of each block from 1MB to infinity, creating endless possibilities.

Transparent Accounting System

With this overwhelming technology, we should consider one simple thing: are we ready for a fully honest, true and transparent accounting system which cannot be manipulated? Are businesses and governments ready to play by the rules? Is the world ready for this level of truly transparent business?

Is Blockchain a game changer for accountants? What do you think? Share your opinion in the comment section.