Is Mainstream Crypto Adoption Being Held Back By “Exclusive” DeFi Platforms?

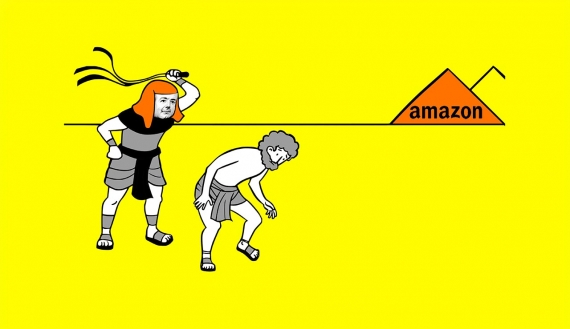

While Bitcoin (BTC) is still the king of crypto, it’s still far off from everyday use. Altcoins are even further off the spectrum, meaning the community has a long way until mass adoption. What is taking so long? The technology has proven itself but that’s not the problem. Many think some of the most popular DeFi platforms, like lending platforms for example, are still too exclusive. High minimum spending amounts are excluding the majority of the developing world from participating in crypto but some new innovative platforms are looking to change this.

Loan seekers need an average of $3,000 to participate in the market

DeFi crypto lending platforms attempt to sell themselves as a way to get more money (through the process of collateral backed loans) without having to sell any crypto assets. They say this will help the “common man” obtain more capital to participate in the crypto market. However, they fail to mention the fine print.

SALT Lending, one of the most popular lending platforms requires a minimum loan amount of $5,000 just to get started. Immediately, this weeds out a large portion of the developing world from seeking a loan and bringing their assets into the global crypto economy. On average, the minimum loan amount for lending platforms is roughly $3,000. Here are a few more minimum loan amount examples.

Nexo: $500

Celsius Network: $3,000

BlockFi: $2,000

YouHodler: $100

Innovative projects; low-barriers of entry will spur mainstream adoption

In the coming years, the crypto market cannot be driven by professional crypto experts alone. Newcomers must be brought in to grow the market and to do this, low barriers of entry must be established. Take lending platform YouHodler for example. It’s $100 minimum for loan seekers is highly-reasonable for the majority of people. Hence, this could very well be the gateway for millions to explore the platform, get comfortable with buying crypto, converting crypto and receiving loans that help them build a diversified crypto portfolio. Another factor to mainstream adoption is the sheer quality of projects.

Binance CFO says quality, not quantity essential for market health

On the topic of mainstream adoption, Binance CFO Wei Zhou said “I think two things will drive crypto adoption. One is the ease of purchasing cryptocurrency...the other one is basically we need more high-quality projects in the ecosystem and we need to attract more intellectual capital for more high-quality founders coming into the ecosystem to build projects.”

Projects that are profit-focused, like some of those lending platforms mentioned above will likely not attract the type of high-quality founders Wei Zhou mentioned. Instead, it will be young platforms like YouHodler, with its low barrier for entry and other attractive features for “newbies” like crypto savings accounts with up to 12% APR. Binance and Kraken are also doing their part to make it easy for beginners to transition from the fiat world to the crypto one at affordable rates.

The change is happening, but not as fast as many have hoped. For us already in the know, this is good news. We have more time to engage with our favorite innovative platforms and prepare for a bright future ahead. Will you join us?