How to Make a Profit with Crypto Lending

Lending is hardly a new phenomenon. Dating back centuries, people have been requesting money from lenders and offering up their valued objects as collateral. You can see this in the banks and pawn shops in today's society. However, along with cryptocurrency, a new method of lending has emerged and this time, it has several, profitable advantages for the loan seeker.

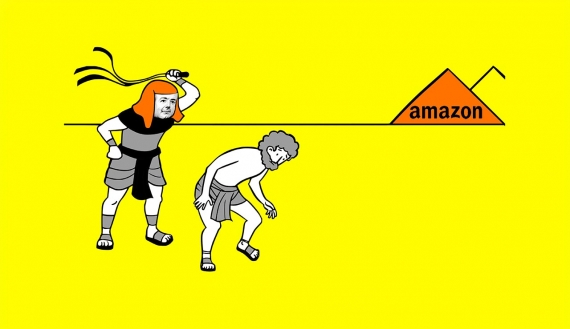

HODL CULTURE: THE BIRTH OF CRYPTO LENDING

The backstory of crypto lending is an interesting one and really helps to understand the psychology of the average crypto enthusiast. To begin, let’s take a look back at November and December of 2017. During this time, the crypto market was experiencing a bull run unlike anything seen before. The hype was at an all-time high and everyone was jumping in the market for a chance at some quick profits. But then suddenly, the hype stopped.

The market started losing steam and those who invested at the peak of the bull run had to make a tough decision. Some got lucky, sold at the top and ran away with the profits. Others eventually panicked and sold their crypto to make as much as they could before things got worse. But there is a select group of holders that never gave up. To this day, they “HODL” waiting for the next bull run. But when will that happen? What if they need cash now but don’t want to give up their valuable crypto. Many innovators asked themselves that same question and came up with an answer.

WHAT IS CRYPTO LENDING AND HOW DO CRYPTO LOANS WORK?

So let’s say you are one of these resilient Hodlers. You still believe the market will bounce back. You believe in crypto. However, you still need cash and you need it now. That’s where the crypto loan comes in. Crypto loan platforms are a unique type of service that lets you put down your crypto as collateral in exchange for fiat at a ratio. Now, there are a few different platforms to choose from, each with their own ratios and features. But the real beauty of these platforms is the freedom to diversify your investments, capitalize on market trends and of course, make a profit.

HOW TO MAKE MONEY WITH CRYPTO LENDING

To make a profit with a crypto lending service, you’ll want to choose one that’s safe, efficient, reputable and gives the best deal. For example, crypto-backed loan service provider YouHodler has the highest loan-to-value ration in the entire industry (up to 85%). After a quick sign up and KYC verification process, simply deposit your crypto and receive cash in return nearly instantly. Now, BTC is stored safely and the loan seeker is free to spend that cash however they want it. To make a profit, one example would be to use that cash to buy another crypto that is in a growing process.

If it’s a bull run, then that means the one who took out the loan made a profit on both the crypto they bought with the borrowed cash and also their BTC stored in the platform. If it’s a bear market, then they can use that cash to capitalize on the low crypto prices and set their portfolio up nicely for another positive market trend in the future (buy low sell high).

On top of this, there are a few different, creative industry tricks of the trade one can use to maximize their profits on a crypto lending platform but that’s a discussion for another time. For the busy crypto trader who does not have the time to monitor the market and wants a relatively safe and easy way to make a passive income, using a crypto lending platform is one innovative way to do it.